Identify your financial aptitude, get just the right courses and avail industry ready certifications that Supercharge your Financial IQ.

Quick, Fun, Insightful courses that help you learn real life finance.

Evergrowing collection of 25+ courses to exceed your hunger for more and suit all aptitudes.

Learn on the go with Sprint courses or binge-watch Marathon courses on weekends.

Forget randomness with our Race Track that is intelligently designed to match your progress.

Kick start your investment journey with most trending courses on Quest!

While investments like FDs can secure your savings, they cannot really grow your money much. Plus, there are high chances that these savings cannot beat inflation and can actually make you lose the chance of getting wealthy!

On the other hand, investing your money smartly can actually multiply your wealth. It's time you step out of the old ways of savings and realise the power of smart investing!

Disclaimer:

This graph is drawn on an estimation basis. We, in no way,

guarantee you any such returns on investing in any asset or financial instrument.

Take this quiz to identify your financial IQ and get your customized course recommendations.

Check your Financial IQ

What are you upto today? Want a quick bite of learning?

* Available as an add on to ONE Subscriber with some courses.

Get customized course recommendations and learn what fits you the best.

What brings you here?

How would you rate your knowledge on stock market?

Youtube Golden button

BSE Institute

SEBI registered

Students

Youtube followers

Total customers

Newbie learners who turned to investors with Finology Quest.

As we promised, we would be bringing new courses every month!

Marathon

Wide Course Variety for those who want to get it all!

One Subscription. Three Products. Unlimited Access.

Your Perfect Financial Plan

Trending Courses on Investing & Finance

Investing Ka Search Engine

Kick start your investment journey with

Finology One at just Rs.499/- per month

Gurus behind the courses, know who you are going to learn from.

Need answers? Find them here

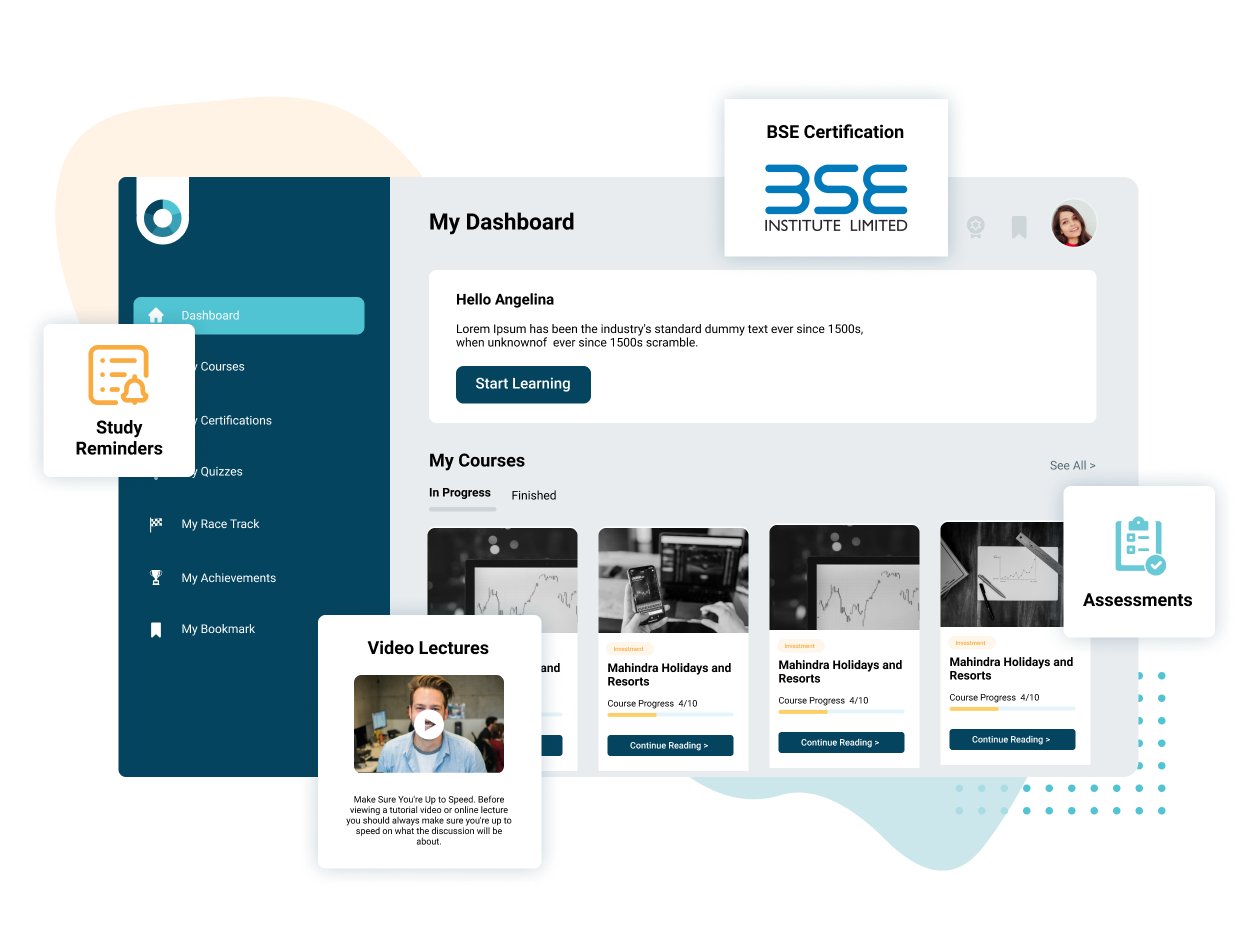

Quest is your ticket to financial freedom. It is a learning platform by Finology that offers you a variety of courses related to finance and investing. After subscribing to Finology One, you can watch or read any course. Quest will make you financially aware and will show you a path towards wealth creation.

With Quest, you get access to well-researched and thoroughly explained courses on finance and investing. For a first-rate learning experience, every course provides downloadable notes, flashcards for revising your concepts, and assessments to test your knowledge.

Nope! You do not need to pay for each course. Just subscribe to Finology One, and get full access to all the courses and other unique resources on the website.

Amidst the city life and routine desk jobs, most people forget to learn the most underrated life skill of money management and financial awareness. Ah! If only being financially literate were a choice. Worry not! Quest fills this gap for you by making financial education not only easy but also affordable.

We do not want you to go! Yet if you wish to cancel your subscription, you can visit the ‘Subscription’ section from the dashboard and cancel your subscription.

Yes, Quest offers four free courses to all users.

Features

Courses Types

Finology

About Finology Quest

Quest is a 101 guide for anyone who wants to learn investing. The aim of these online finance courses is to make people financially literate and to make them understand the essential financial concepts and learn company analysis, so that one can know how to create & grow their wealth in the stock market.

Why choose Quest?

Quest will make you aware about investing and the secret to growing wealth. As against popular opinion, you do not always need to earn more money to be rich. In fact, financial awareness is the key to wealth creation & Quest will help you to make this journey simpler. The courses in Quest are easy to understand and explained using close-to-reality scenarios which makes learning fun and relatable. Plus, you can access it anytime and anywhere on the go, which is a cherry on the top!

For whom the Quest is?

Quest is for anybody who wants to enjoy learning finance and investing on the go. The aim of Quest is to make people financially aware. So, if you are someone making your babysteps into the markets, look no further. From personal finance to investing, Quest is your one-stop platform for almost everything finance!

Disclaimer:

The companies discussed on this website are solely for educational purposes and should not be construed as investment advice. We may or may not hold positions in any or all of these companies. However, these aren't recommendations and hence, we held no responsibility for any consequences of investment actions based on these videos.